The world is growing smart and fast every day. In a struggle to move towards a cashless society, mobile payments are storming the world right now. Earlier, credit and debit cards replaced the wallets, and now mobile payments have even replaced the credit cards. So, you might forget your credit card, but you never forget your cell phone. What could be more comfortable than sliding your cellphone out of your pocket, making a payment, and sliding it back? That’s how mobile payments are revolutionizing the conventional payment systems right now. In this article, we will discuss some of the existing and future mobile payment techniques that are taking the modern world like a storm.

Wait a minute! What are Mobile Payments?

Mobile payments refer to payment techniques that enable a customer to purchase, pay or transfer money through their cellphone. You don’t need to physically pay the currency notes. In fact, it is the digital currency that transfers from one account to another. You can pay for booking travels, online purchase, paying bank loans, bill payments, money transfer, etc. All these facilities reside in your pocket!

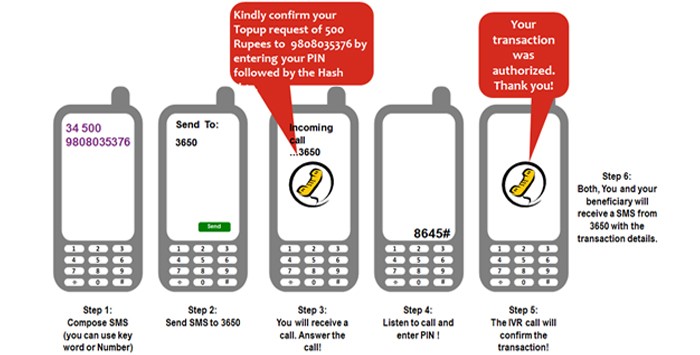

SMS Payments

Source: Hello Paisa

It is the simplest and easiest method of mobile payment. When a customer makes a purchase, the retailer sends the details of purchase to the mobile operator. On the other hand, the customer receives a text message from the retailer for approving the customer’s credentials. The customer replies with some specific code, and the amount is deducted from customer’s mobile account. Though it is less secure, still it is preferred for people not possessing a smartphone.

NFC- Near Field Communication

Source: Due

NFC, as the name depicts, is used for short-range communication. This range is usually a few inches. NFC works on the principle of radio frequency identification. So you don’t need to swipe card or touch your cellphone to POS (point of sale) system. Most of the new cellphones are embedded with NFC technology. Holding the cellphone in front of the receiver makes the payment in a few seconds. In China and Japan, NFC is being used for making payments at public transport and even for getting identity cards. This technology is enriching day by day, and mobile operators are interested in it because of its robustness.

Mobile Wallets

Source: Temi

A mobile wallet is your digital wallet that carries your money in digital form rather than currency notes. It digitally encrypts your money and transfers it from one account to another. So, one knows that he has money, but it’s not in hand. Instead, it is on your smartphone. Mobile wallets have played a vital role in the development of a cashless society. You might have heard of Apple Pay, Samsung Pay or Android Pay. These are actually your digital wallets. You need to install the application on your smartphone. You can pay with your digital wallet at all the stores accepting digital payments. Even gamers can pay for the online game purchase using mobile wallets. It is the most popular payment mode at the time because of its ease of payment and great security. These apps are heavily backed by firewalls that make them foolproof.

Mobile Card Readers

Source: PC Mag

Some mobile accessories can also serve you to make mobile payments. Square has introduced Square Reader that is attached to the headphone jack of your smartphone and works as a mobile POS. One can swipe his card and make the payment. PayPal has also jumped into the race with the introduction of PayPal Here. QuickBooks GoPayment also features mobile payment to be made from your QuickBooks account.

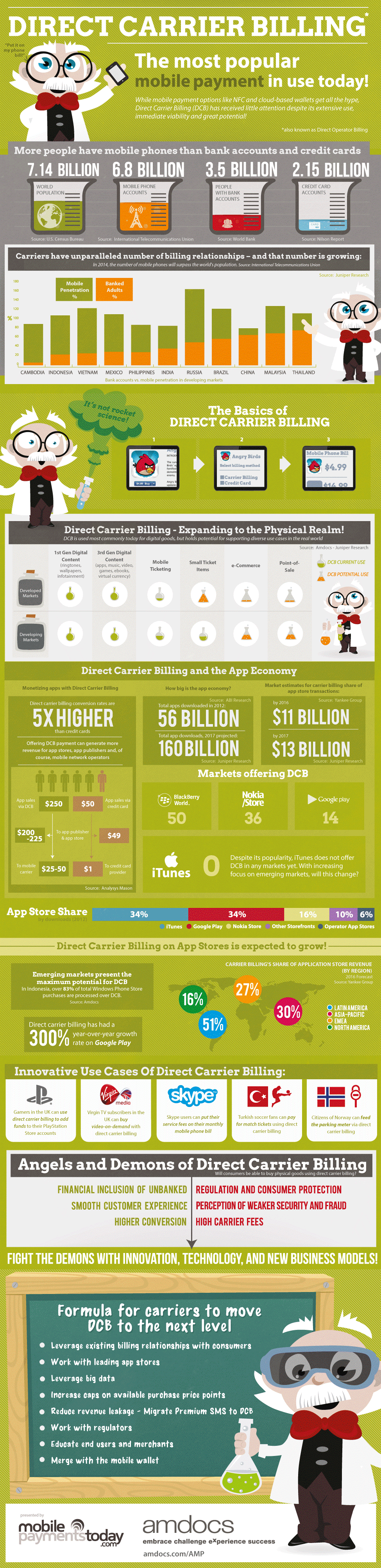

DCB – Direct Carrier Billing

DCB has made mobile payments much convenient and affordable. As compared to mobile wallets that use your specific application account, DCB utilizes your cellular balance to make payments. The idea initiated several years ago before smartphones were born. When mobile phone balance was used to purchase ringtones and wallpapers. With the emergence of smartphones, DCB has embedded its roots into android apps purchase and online payment. One can even pay for intangible items like online games and gaming vouchers using DCB. Using DCB, you don’t need to create separate accounts for different services. All you need to do is to top-up your mobile account and start purchasing. Post-paid services facilitate a step further by charging at the end of the month. An infographic by Mobile Payments Today gives a better understanding of carrier billing.

Source: Mobile Payments Today

The importance of DCB was demonstrated in this year’s Level Up KL. Held in Kuala Lumpur, Level Up KL is among the largest games development conference in the region featuring game development content, workshops, B2B meetings, exhibits from key players in the industry, keynotes, and high-level sessions. Moderator of the session about “the Future of Mobile Payment”, Johary Mustapha, CEO of Forest Interactive, said that you can pay for anything with a single account and gave some tips on how you make people actually pay for your game.

Talking about games, Wallet Codes is a great example of DCB, created to enable the purchase of Steam wallet codes in order to acquire games, it makes gamers buying process much easier.

Closed-loop Payments

Closed-loop payments correspond to methods when companies create their own mobile payment system. This system is for the specific companies from where the sale or purchase has been made, and that particular company owns that payment method.

Source: NFC World

Companies like Walmart, Starbucks, Taco Bell, Subway, and Sonic have their own payment systems where you can either pre-pay or pay after availing their services. Amazon is reaching skies right now with the introduction of Amazon.go. It is a digitalized retail store that is a great amalgam of artificial intelligence (AI) and smart payment. You can simply walk-in, pick up your favorite item, and leave the store. But how the payment is made? Exactly! That’s where AI jumps in, and the algorithms detect the items that you pick up and deduct the relevant cost from your Amazon account.

Mobile POS

Source: WEX

POS stands for “point of sale.” POS systems are usually placed in retail stores and cash & carries. You don’t need to wait in the queue for long. Instead, you just have to tap your cellphone on the card-reader or press a button on your cell, and the payment is made. See! How simple!

To conclude…

Mobile payments are contributing a lot to the development of a cashless society. WAP (Wireless Application Protocol) is being integrated with SMS payments to provide extra security. It is believed that bank accounts will soon become obsolete and mobile payments will rock the world. Though mobile payments are robust, mobile operators will have to consider the security of mobile accounts that is a significant threat to mobile payments at the time.